Good morning. This is a special breaking news edition of Trendlines, my business column and newsletter that cover the forces shaping the economy in Boston and beyond. If you’d like to receive the newsletter via email on Mondays and Thursdays, sign up here.

An early tally of the impact of President Trump’s tariffs is in — and it’s, well, not encouraging.

The US economy shrank in the first quarter, the first decline in three years, the Commerce Department said on Wednesday.

The drop was caused by an atypical factor: “frontloading” — businesses buying up imported goods before new tariffs kicked in. A modest slowdown in consumer spending also played a role.

The country is not in a recession. The economy often bounces back after a bad quarter.

But forecasters put almost even odds on a recession — typically defined as two consecutive quarters of negative growth — in the next year. That’s up from a benign 20 percent when Trump took the oath of office in January.

While the tariff hit to the economy wasn’t unexpected, US stocks tumbled on the news. Prices recovered partially as the day went on.

What happened?

Gross domestic product — the value of goods and services produced in the country — fell 0.3 percent in the first three months of the year.

For comparison, GDP rose 2.4 percent in the fourth quarter, and an average of about 3 percent over the past two years.

Why the sudden downturn?

Tariffs.

The rush by businesses to stock up before the new duties took effect triggered a surge of imports. In arcane world of GDP accounting, imports subtract from growth because the goods are produced outside of the United States.

The gap between imports and exports sliced 5 percentage points off GDP, the most on record.

Consumers — whose purchases power two-thirds of the economy — continued to open their wallets during the quarter. But spending was less robust than in the fourth quarter and didn’t offset the flood of imports.

Should I be worried?

A recession isn’t a foregone conclusion.

The tariff shock could prove temporary. A separate measure of economic health — called real final sales to private domestic purchasers — rose a solid 3 percent in the quarter.

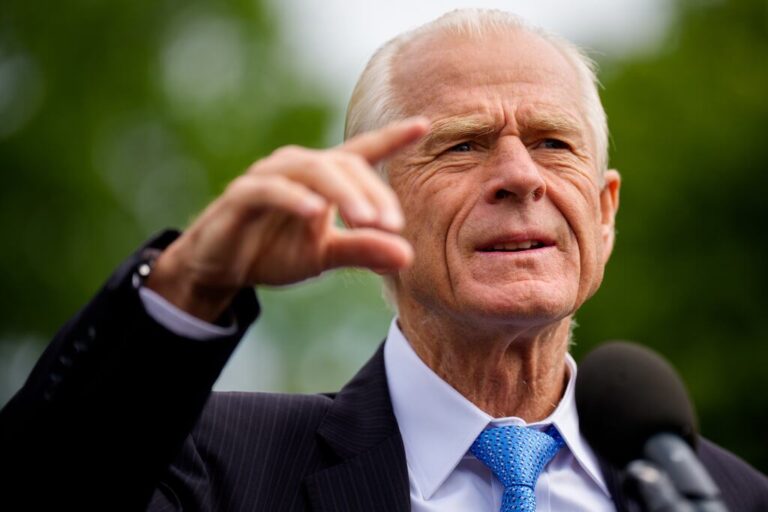

Trump trade adviser Peter Navarro told CNBC that the GDP report was “the best negative print I have ever seen in my life.” Trump blamed Joe Biden.

But there’s good reason to be nervous.

Frontloading sets the stage for a sharp falloff in purchases down the road, Gregory Daco, chief economist at the consulting firm EY-Parthenon, said in a note. That will be a “far more troubling phase of the ongoing economic slowdown,” he said.

The president’s decision to build a tariff wall around the United States has upended a global trading system that’s been in place since the end of World War II. The system has delivered cheap foreign goods to American consumers but also contributed to a sharp decline in domestic manufacturing.

Trump’s aggressive rollout has raised the specter of price increases so steep that exporting to the United States won’t make economic sense.

Torsten Slok, chief economist for Apollo Global Management, forecasts “COVID-like shortages” and significant layoffs in industries spanning trucking, logistics, and retail.

Moreover, Trump has created so much uncertainty among businesses that a growing number say they can’t forecast their earnings. Some companies have slowed hiring.

Investors recoil at uncertainty. As of Tuesday, the Standard & Poor’s 500 index was down 7.3 percent since Trump took the oath of office.

But it’s early days, right?

Correct.

Trump says his trade policy will revitalize US production, create good-paying factory jobs, and generate revenues that can be used to lower taxes. He’s warned of initial disruption but insists the country will be better off in the long run.

But most economists — and a growing number of business leaders — disagree. Consumer confidence has plunged.

What’s next?

A monthly jobs survey released Wednesday by ADP showed a downshift in private sector hiring in April. The Labor Department’s more comprehensive report is due out on Friday, and the consensus among forecasters is that employment growth will slow but remain positive.

But there’s no denying the outlook has darkened.

“While there is a lot of noise in the investment, imports, and inventories components, there is no question that the fundamentals of the economy have deteriorated rather sharply,” said Boston College economist Brian Bethune.

In other words, buckle up.

Markets are calmer but the economy wobbles as Trump’s tariffs face legal fightsTrump covets control of the Federal Reserve. The market wants him to back off.US economy shrinks 0.3% in first quarter as Trump trade wars disrupt businesses

Comment count: